What can I expense as a fashion freelancer?

“I once wrote off things I bought at the Dover Street Market sample sale."

Like clockwork, on 31st January, most fashion freelancers across the UK strap in for their annual ritual: a last-minute dash to file a tax return that could've been completed months ago.

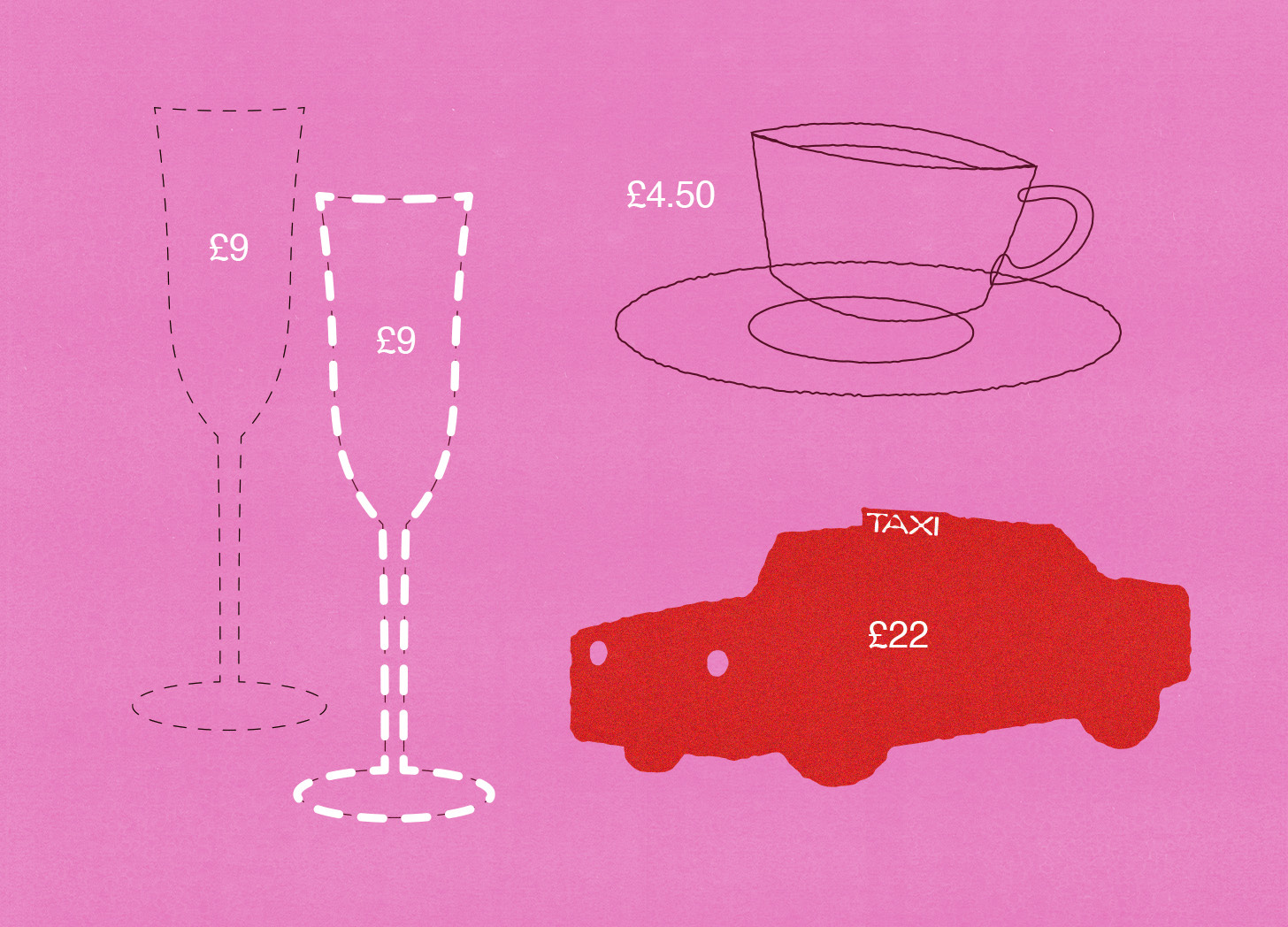

Trawling through hundreds, if not thousands, of vague transactions on their bank statements, freelancers do their best to write off as much as possible, marking travel fares, Business of Fashion subscriptions and Soho House memberships as potentially valid expenses.

Of course, the spectrum of ballsiness amongst freelancers varies. Some won’t think twice about filing an expensive designer shopping spree under their tax-deductible allowance. Uniform, right? Others wouldn’t expect relief on a Thursday morning client breakfast. Naturally, the industry is rife with rumours of obscene fiddling: so-and-so’s boss from [insert PR agency] sliding a Harley Street tweakment past the taxman, a certain influencer expensing their Ozempic and that editor putting her taxi to Hershesons under mileage allowance.